As of March 24 2020 hearings at the First Tier Tax Tribunal and Upper Tribunal were forcibly postponed due to the global pandemic. The only caveat being, those that could be held remotely could still be heard, if agreed by all parties. The FTT announced last week that this postponement would last until at least the end of June where they would review their decision.

The FTT have been under pressure to increase the number of remote hearings, however have stated that they are under-resourced and are struggling with the increasing number of delayed hearings.

There are problems with the First Tier Tribunal is not geared up to hear cases which involve numerous witnesses that need to dial in

Tim Brown – Temple Tax Chambers

The tax policy director at the Chartered Institute of Taxation, John Cullinane, has stated that these delays will prevent both taxpayers and HMRC bringing “frivolous case” to the FTT and ease the overwhelming workload on the FTT.

How many companies may be affected by this delay?

The worry for many companies is that they may not survive the delay in physical hearings. This may be a significant number considering that the FTT had a backlog of 27,820 tax disputes last quarter, which was up from 26,010 in the preceding three months. However, a government spokesperson has attempted to ease the worries of UK businesses and taxpayers by stating:

“It is important that the tax system continues to function so it can fund vital public services like the NHS but HMRC will deal sympathetically with taxpayers who cannot meet their tax obligations on time, or appeal or review HMRC decisions within the usual time limits”

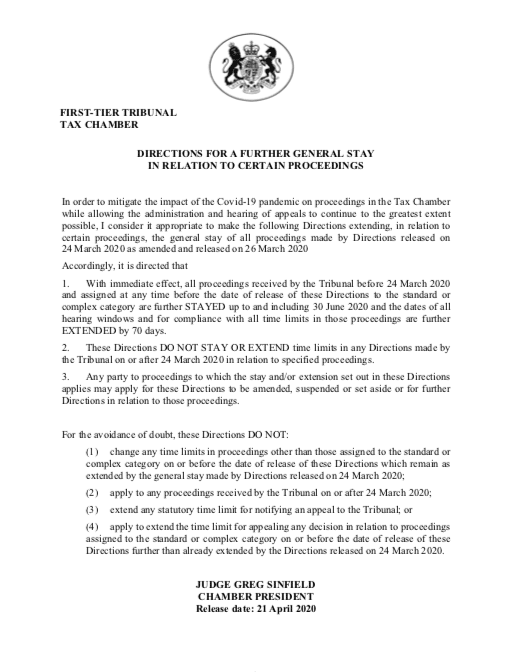

Please see below the announcement made by the FTT:

Book your Initial Consultation with our Specialist Tax Solicitors

Our specialist Tax Solicitors and Barristers deliver expert technical knowledge, strong negotiation skills and advice which can make a pronounced difference to eventual tax penalties, charges and liability.

We provide tax advice and representation against HMRC. Get in touch with our expert tax solicitors and barristers so we can get you a result. We provide a quick no cost initial telephone case review to establish whether or not we can help you; just call one of our team on 02071830529.

Want legal advice from Tax Solicitors on your case?

Our simple enquiry form goes immediately to our tax litigators in Middle Temple, London. Call us on +442071830529 from 9am-6pm.