HMRC have rolled out their latest weapon to combat offshore income or gains, in the form of “nudge letters”. These letters from HMRC’s Risk and Intelligence Service are based on information from overseas tax authorities and intend to prompt taxpayers to make voluntary disclosures.

If you need HMRC Tax Investigation advice, we are available to aid you at every stage of the HMRC investigate process. Members of our legal team have first-hand experience and knowledge of the internal workings of HMRC. We can provide you with the very best representation in negotiations with HMRC and defending all forms of HMRC fraud, tax inquiry, tax fraud investigation, criminal tax evasion and HMRC enquiries and investigations. Our team specialises in successfully challenging HMRC decisions and will assist you in every aspect of the investigation.

What is a nudge letter from HMRC?

The intention of the nudge letter is to prompt UK taxpayers into reviewing their tax returns to check whether they need to notify HMRC of any further gains, income or profits which they are yet to disclose.

If you are unsure if you have received a “nudge letter” from HMRC, you can see an example of one here.

What are my obligations with a nudge letter?

It is important to remember that HMRC do not issue nudge letters to all taxpayers whose returns may be wrong, they could simply opt to start a tax investigation.

As per ss 106B-D of the Taxes Management Act 1970, failure to disclose offshore income, assets or gains, may result in HMRC opening a criminal investigation. By virtue of the Tax Management Act if you dishonestly make a false statement to evade paying tax, it will be a criminal offence which can result in both an investigation and criminal prosecution.

Do I need to respond to the nudge letter?

It is very important that you do not ignore a nudge letter from HMRC as failure to do so may result in HMRC launching an enquiry or tax investigation into your tax affairs. It is therefore vital that you instruct specialist tax solicitors in this instance to prepare a response on your behalf.

The recent guidance posted by the Chartered Institute of Taxation makes it clear that whilst HMRC cannot compel you to use any specific method for disclosure, you should respond to HMRC’s letter to mitigate the risks of further action being taken.

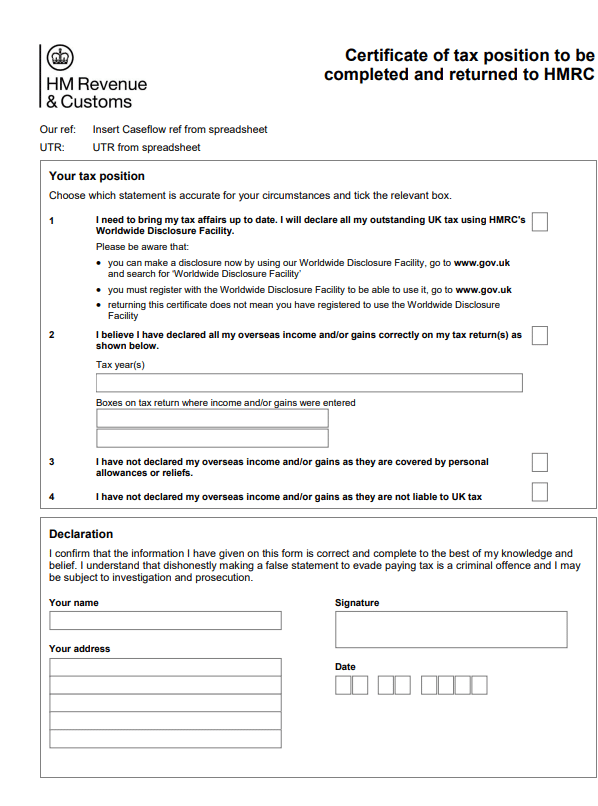

Recipients of a nudge letter will have 30 days to respond to HMRC with a completed Certificate of Tax Position. In completing this certificate you will either be confirming:

- Your tax affairs are not up to date and that you will be making a voluntary disclosure via the Worldwide Disclosure Facility (“WDF”); OR

- Your tax affairs are up to date and therefore there is no additional tax payable and all offshore income, gains and assets have been declared, as required.

I have just received a nudge letter from HMRC, what next?

Whilst there is no legal obligation on you to complete the Certificate of Tax Position, the CIOT advise that it is best to respond to the nudge letter as failure to do so may cause further investigation.

The Certificate of Tax Position contains a formal declaration by the taxpayer that the information provided is “correct and complete” to the best of the taxpayer’s knowledge and belief. Therefore, the CIOT suggest in their guidance that it may be preferable to respond to the nudge letter with a letter, which will allow you to explain fully any offshore incomes or gains, thus avoiding a tax investigation.

Can you appeal against a tax investigation being opened?

No, unfortunately you cannot appeal against an investigation being opened.

However, once HMRC have concluded their investigation and issued a penalty, then you have 30 days to appeal the decision. You can appeal in writing by giving Notice of Appeal to HMRC. HMRC will either confirm their first decision, amend their decision or agree with your assessment.

If your position cannot be agreed with HMRC then two further options are available. HMRC could offer an internal review of the disputed decision (or you can request this procedure at any time). The review is an entirely internal procedure completed not by the original HMRC decision maker but by a different HMRC officer.

You could also appeal to the First Tier Tax Tribunal if you cannot agree your position following the review. The independent tribunal will make a determination on the case. A further appeal is permitted if you do not agree with the decision.

We have a proven track record of successfully contesting disputed tax assessments and penalties with HMRC. We are experts in adeptly presenting evidence and employing bespoke arguments combining the facts of your case, previous cases and current legislation to ensure your appeal is a successful one.The tax authorities have lost many cases that are appealed through negotiation, internal review or through the Tax Tribunal.

Detailed advice on HMRC Tax Appeals can be found here.

Expert London Tax Investigation Lawyers

If you need HMRC Tax Investigation advice, we are available to aid you at every stage of the HMRC investigate process. Members of our legal team have first-hand experience and knowledge of the internal workings of HMRC. We can provide you with the very best representation in negotiations with HMRC and defending all forms of HMRC fraud, tax inquiry, tax fraud investigation, criminal tax evasion and HMRC enquiries and investigations. Our team specialises in successfully challenging HMRC decisions and will assist you in every aspect of the investigation.

Our specialist Tax Solicitors and Barristers deliver expert technical knowledge, strong negotiation skills and respected advice, which can make a pronounced difference to eventual tax penalties, charges and liability.

Want legal advice from Tax Solicitors on your case?

Our simple enquiry form goes immediately to our tax litigators in Middle Temple, London. Call us on +442071830529 from 9am-6pm.