HMRC has begun sending nudge letters to 3,000 employers each week advising them they may need to repay amounts received under the Coronavirus Job Retention Scheme.

The intention of the letters is to give employers the opportunity to review their records and their claim in case of any “mistakes” that may have taken place when claiming grants. It is expected that some businesses may have claimed grants that are greater than businesses are entitled to or may not have met the conditions of the scheme.

If you need HMRC Tax Investigation advice, we are available to aid you at every stage of the HMRC investigate process. Members of our legal team have first-hand experience and knowledge of the internal workings of HMRC. We can provide you with the very best representation in negotiations with HMRC and defending all forms of HMRC fraud, tax inquiry, tax fraud investigation, criminal tax evasion and HMRC enquiries and investigations. Our team specialises in successfully challenging HMRC decisions and will assist you in every aspect of the investigation.

What is a nudge letter from HMRC?

The intention of the nudge letter is to prompt UK taxpayers into reviewing their tax returns to check whether they need to notify HMRC of any further gains, income or profits which they are yet to disclose.

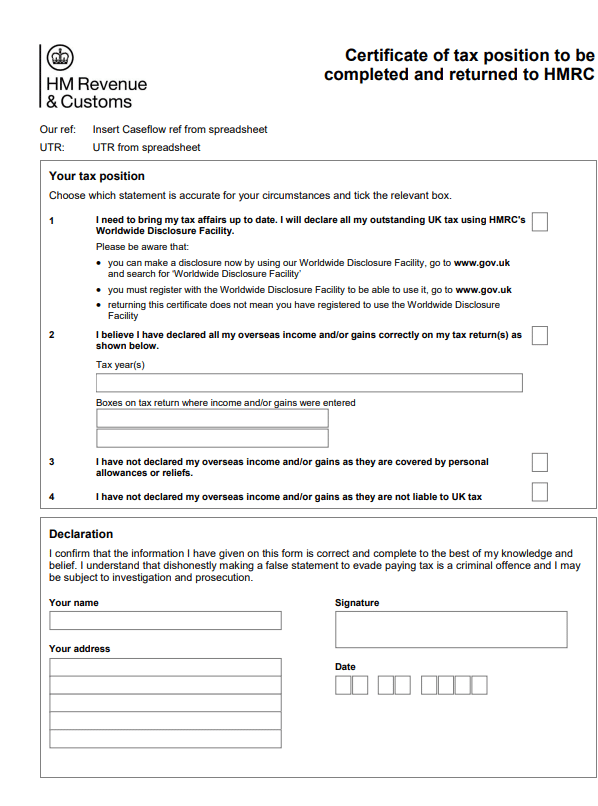

If you are unsure if you have received a “nudge letter” from HMRC, you can see an example of one here.

How should employers respond to the “nudge letters”?

Whether or not a businesses believes they have over claimed or not they have been told they should contact HMRC either way.

Employers should ensure that all staff that were put on furlough complied with the rules of the scheme whether or not a letter was received from HMRC. HMRC advise that those who have breached the rules should take advantage of the amnesty time limit to repay the fees in order to avoid penalty fees.

What does the amnesty time limit cover?

The amnesty time limit covers the following behaviours:

- Not being aware that remote staff are working;

- Technical or computational issues;

- Remittance delays ; and

- Deliberate fraudulent behaviour

This will be the only chance employers have to remedy their position without sanction or penalty but will need to respond promptly according to HMRC.

Those who do not notify HMRC within the ‘amnesty’ period, the first significant date for which is 20 October 2020, but knew they had received the money or stopped being entitled due to a change in circumstances will be liable for a penalty on the basis that the wrong doing was deliberate and concealed. This could give rise to a penalty of 100%.

Although some employers may have told workers they must not work when furloughed they may have generated large volumes of emails during this period. Alternatively, head office may have given directions regarding the prohibition of working while furloughed but this may have been ignored by some line managers.

What will happen if employers are found to not be entitled to furlough payments?

If employers are found to have not been entitled to their claimed grant, the payments can be clawed back by way of a 100% income tax charge regardless of whether the claim was made innocently or deliberately.

Employers will also not be entitles to payments where an employee may have left or the employer has not used the amount to pay the intended costs within a reasonable period.

How has HMRC tried to prevent furlough fraud?

According to HMRC, the Coronavirus Job Retention Scheme has four key protections against fraud:

- Employees must have been added to payroll on or before 19 March 2020 in order to limit the use of “fake employees”;

- Claims can only be accepted from employers who are authenticated by HMRC;

- All claims are to be assessed by a specialist team within a 72 hour window; and

- Proportionate and reasonable interventions with customers after the money has been paid.

Rule changes that were enforced since 1 July 2020 are also expected to make furlough fraud less likely as employers are now able to bring furloughed employees back to work for varying amounts of time. However, this would not stop employers from saying employees have worked one day when in actual fact they have worked four days.

How will deliberate furlough fraud be treated?

Deliberate behaviour that is not corrected using the amnesty time limit will also potentially expose employers to HMRC’s criminal powers, as well as HMRC’s powers to publish details of deliberate tax defaulters in order to ‘name and shame’.

In July HMRC made it’s first arrest in a ‘dawn raid’ as part of an investigation into a suspected £495,000 furlough fraud.

HMRC has a hotline for reporting furlough fraud and has already received around 7,000 reports of abuse.

Can you appeal against a tax investigation being opened?

No, unfortunately you cannot appeal against an investigation being opened.

However, once HMRC have concluded their investigation and issued a penalty, then you have 30 days to appeal the decision. You can appeal in writing by giving Notice of Appeal to HMRC. HMRC will either confirm their first decision, amend their decision or agree with your assessment.

If your position cannot be agreed with HMRC then two further options are available. HMRC could offer an internal review of the disputed decision (or you can request this procedure at any time). The review is an entirely internal procedure completed not by the original HMRC decision maker but by a different HMRC officer.

You could also appeal to the First Tier Tax Tribunal if you cannot agree your position following the review. The independent tribunal will make a determination on the case. A further appeal is permitted if you do not agree with the decision.

We have a proven track record of successfully contesting disputed tax assessments and penalties with HMRC. We are experts in adeptly presenting evidence and employing bespoke arguments combining the facts of your case, previous cases and current legislation to ensure your appeal is a successful one.The tax authorities have lost many cases that are appealed through negotiation, internal review or through the Tax Tribunal.

Detailed advice on HMRC Tax Appeals can be found here.

Expert London Tax Investigation Lawyers

If you need HMRC Tax Investigation advice, we are available to aid you at every stage of the HMRC investigate process. Members of our legal team have first-hand experience and knowledge of the internal workings of HMRC. We can provide you with the very best representation in negotiations with HMRC and defending all forms of HMRC fraud, tax inquiry, tax fraud investigation, criminal tax evasion and HMRC enquiries and investigations. Our team specialises in successfully challenging HMRC decisions and will assist you in every aspect of the investigation.

Our specialist Tax Solicitors and Barristers deliver expert technical knowledge, strong negotiation skills and respected advice, which can make a pronounced difference to eventual tax penalties, charges and liability.

Want legal advice from Tax Solicitors on your case?

Our simple enquiry form goes immediately to our tax litigators in Middle Temple, London. Call us on +442071830529 from 9am-6pm.