HMRC are increasingly turning to the Companies Court to collect unpaid taxes and threatening to wind up and shut down companies that have not paid their taxes. Get in touch with us to help you defend HMRC’s threats – we are the UK’s leading specialists in resolving HMRC Tax Disputes.

HMRC TAX DISPUTES LEGAL ADVICE & DEFENCE

Our lawyers have a track record of successfully challenging HMRC decisions and will assist you to get an optimal result. We analyse the merits at the very outset in an initial video conference together with leading (ex-HMRC and Big 4) tax litigation counsel. We provide urgent advice and representation to clients from our unique expert team of established Tax specialist solicitors and barristers with a proven track record of delivering results. Call us on +442071830529, or email [email protected].

Ignoring HMRC Warning to wind-up my Company?

Facing a winding-up petition from HMRC is a serious matter for your company. Such a petition signifies that HMRC is taking legal action to force the compulsory court-ordered liquidation and closure of your business due to unpaid tax obligations. If the petition is successful, it can lead to severe consequences, including the appointment of a liquidator, freezing of bank accounts, asset seizures, closure of operations and investigation into director conduct.

Having a winding-up petition issued against your company can severely damage its reputation and credibility, making it challenging to secure future financing, attract customers, or maintain relationships with suppliers and business partners. It may also result in the loss of valuable assets and the dismissal of employees.

To protect your company’s interests and ensure its survival, it is crucial to seek immediate legal advice from experienced solicitors who specialise in handling winding-up petitions. We can guide you through the legal process, explore possible defence or negotiations with HMRC, and help formulate a strategic plan to address the outstanding tax issues. By engaging legal experts, you increase your chances of achieving a positive outcome, such as reaching a settlement, implementing a repayment plan, or resolving the dispute in a way that allows your business to continue its operations.

Remember, taking prompt action and seeking professional legal assistance is crucial when facing a winding-up petition, as it can make a significant difference in protecting your company’s future and minimising the potential adverse effects on your business.

What is a 7 day warning letter from HMRC?

The warning letter is pre-action communication that HMRC intends to issue a winding up petition; effectively a letter before claim. The intention is to prompt the company into paying the debts it may owe or agreeing a time to pay (which HMRC often refuse unless you are professionally represented and advance good arguments for acceptance). Usually issued as a last resort by a creditor chasing its debts, a warning letter is often the last notice you will receive before the matter escalates to a more serious level. A warning letter from HMRC threatens to institute the presentation of a winding-up petition at the Companies Court. This is obviously a very serious matter that could jeopardise an entire company including its creditworthiness. It is critical to take professional legal advice from an expert.

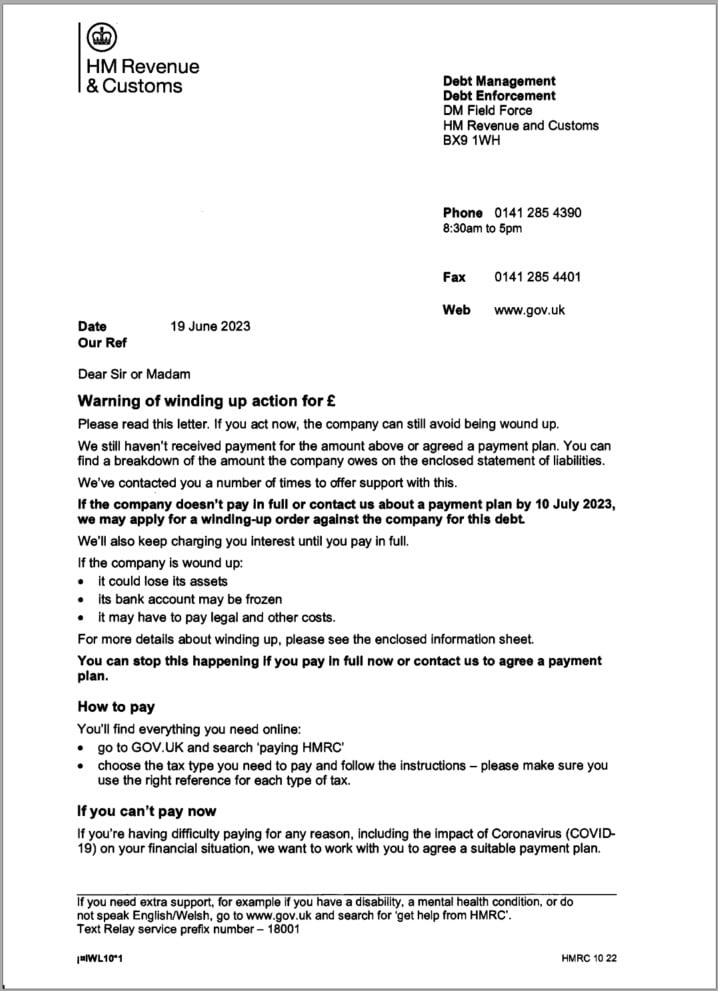

HMRC’s Warning of winding up action letter

Please read this letter. If you act now, the company can still avoid being wound up.

We still haven’t received payment for the amount above or agreed a payment plan. You can find a breakdown of the amount the company owes on the enclosed statement of liabilities. We’ve contacted you a number of times to offer support with this. If the company doesn’t pay in full or contact us about a payment plan, we may apply for a winding-up order against the company for this debt. We’ll also keep charging you interest until you pay in full.

If the company is wound up:

-it could lose its assets

-its bank account may be frozen

-it may have to pay legal and other costs.

For more details about winding up, please see the enclosed information sheet. You can stop this happening if you pay in full now or contact us to agree a payment plan.

What should I do if I have received a warning letter from HMRC?

A warning letter from HMRC usually gives you at least seven days (often more) to respond and take positive action. Time, however, is of the essence. Even if you cannot pay the debt owed, it is essential that you consider the options available to you.

In many circumstances, especially if you have professional advisers to respond to HMRC, HMRC may be open to negotiating a repayment plan under a Time to Pay Arrangement (TTP). Under the TTP, HMRC may agree to reasoned and carefully proposed affordable monthly payment options that factor in income as well as the debt owed.

The company may also choose to undergo a Company Voluntary Arrangement (CVA). This will essentially allow the company to apply for a stay in winding-up proceedings as it negotiates a plan that attempts to rescue the business and pay off any creditors.

What happens if I do not act upon a HMRC warning letter?

Not acting within the 7 days the warning letter afforded you now means that HMRC will present, issue and serve a winding up petition and advertise this winding up petition petition in the Gazette. This will lead to your company’s bank accounts being frozen, leaving you practically unable to trade. A public winding up petition hearing would ensue.

What does a winding up petition do?

A winding up petition seeks to put a company into compulsory liquidation. If successful, all the assets of the company are collected and distributed amongst creditors. The company will continue to carry on business and can enter and complete transactions, however, this can only be for the purpose of winding up its affairs in the interest of creditors and shareholders.

No dispositions for value can be executed by a company that has been faced with a winding up order and any other transactions entered into will be void.

How can we help you oppose a 7 day warning letter from HMRC?

If you are a debtor who has received a warning letter and are unable to resolve the matter, we can help you. With years of experience in negotiating with creditor, shareholder or director petitioners, particularly HMRC, we can obtain adjournments to allow you time to negotiate and settle or to defend a winding up petition.

We also help companies to avoid having bank accounts frozen by preventing the advertisement of winding up petition notices or (if already advertised in the London Gazette) by obtaining a validation order from the Court to unfreeze the company’s bank accounts.

Instruct Specialist Winding Up Lawyers

We provide a no cost initial discussion by phone call (02071830529) to establish whether or not we can help you by organising a discounted fixed fee advice conference for you with and ex-HMRC barrister and our experienced solicitors. We are a specialist City of London law firm made up of Solicitors & Barristers and based in the Middle Temple Inn of Court adjacent to the Royal Courts of Justice. We are experts in dealing with matters surrounding insolvency in particular issues. Our team have unparalleled experience at serving statutory demands, negotiating with debtors/creditors, setting aside statutory demands and both issuing and defending winding up petitions vigorously at the Royal Courts of Justice (Rolls Building), or the relevant High Court District Registry or County Court with jurisdiction under the Insolvency Rules.

Want legal advice from Tax Solicitors on your case?

Our simple enquiry form goes immediately to our tax litigators in Middle Temple, London. Call us on +442071830529 from 9am-6pm.

ACT PROMPTLY

Please note that if you have been warned about your file being passed to HMRC’s Solicitor’s Office or have been served a statutory demand or winding-up petition do not delay in taking legal advice. Your matter can be handled more effectively the sooner you contact us.